WTI Price Forecast: Retreats from YTD high at 116.24 as bulls take a breather

- Western Texas Intermediate (WTI) has rallied near 57% since January 2022.

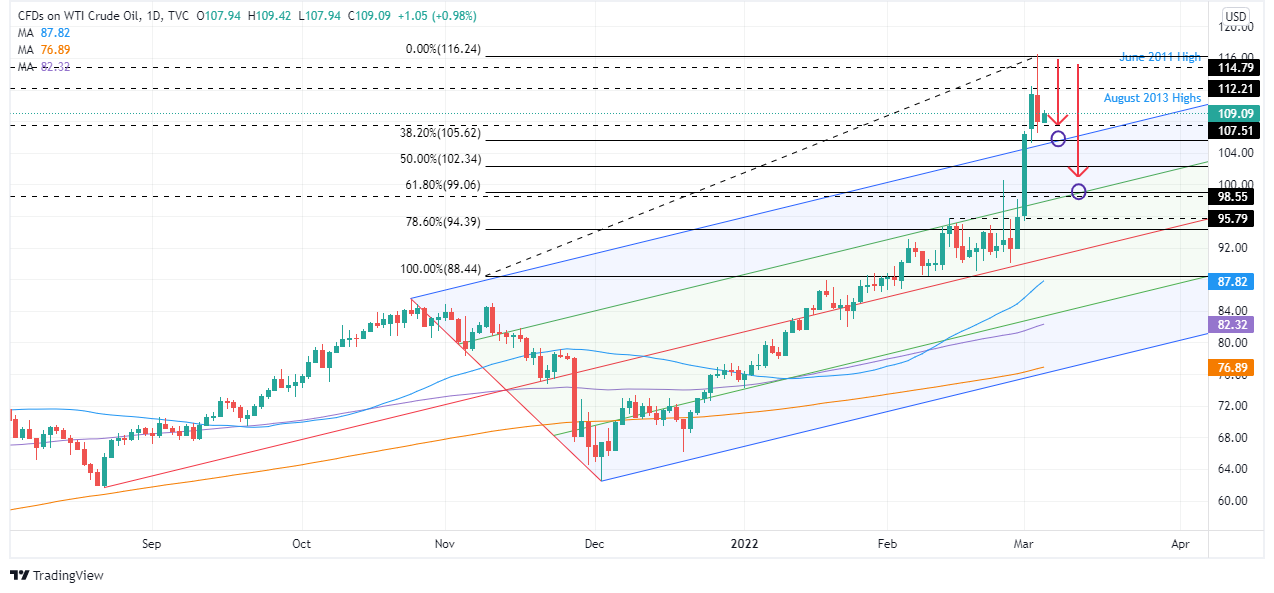

- WTI Technical Outlook: Bullish biased, though in the near-term, might correct to the 61.8% Fibonacci before resuming the uptrend.

Western Texas Intermediate (WTI) gave way some of Wednesday’s gains on Thursday, but so far as the Asian Pacific session starts, the black gold is trading at $109.17 per barrel at press time. Futures in Asia fluctuate between gainers and losers, portraying a mixed market mood. The greenback ended Thursday with gains of 0.38%, at 97.727, and investors get ready for the US Nonfarm Payrolls report on Friday.

That said, from a technical perspective, WTI is upward biased, but a steeper rally left it at the mercy of a mean reversion move that happened on Thursday when US crude oil fell from $116.51 highs to $106.45.

WTI Price Forecast: Technical outlook

WTI’s bullish biased, as shown by the daily chart. US crude oil price is $30.00 higher than the 50-day moving average (DMA), reflecting the movement’s strength. However, it is worth noting that Thursday’s price action, as depicted by candlesticks, left an upper wick more than half of the real-body size, meaning that profits were taken as traders prepared for the weekend.

That said, WTI’s in the near term might print a leg-down before resuming the uptrend. Oil’s first support would be the confluence of Pitchfork’s channel top-trendline and the 38% Fibonacci at $105.62. Once cleared, the next support would be the 50% Fibonacci at $102.34. Breach of the latter WTI’s would face the confluence of Pitchfork’s 75% parallel trendline with the 61.8% Fibonacci level just below the $100 mark at $99.06.