WTI is on the move to the upside with cycle highs in focus

- US oil glides to the upside from the rising 10-EMA.

- Investors backing the black gold on tighter supply factors.

West Texas Intermediate crude is higher on Tuesday as buyers emerge and dash prospects of a deeper and longer-term correction on the daily chart.

Investors anticipate tighter supply while the immediate future, the are expectations of a further draw in global crude inventories provided support.

At the time of writing, WTI is higher by some 1.5% at $75.26 after climbing from a low of $73.70 and reaching a high of $75.47.

For the forthcoming data and projections, US crude inventories were expected to have dropped 4.4 million barrels last week.

Industry and government weekly reports are due respectively at 4:30 p.m. EDT today and on Wednesday.

Meanwhile, investors are concerned that a surge in COVID-19 Delta variant cases will be problematic for demand forces.

The World Health Organization has recently warned that the Delta COVID-19 variant was becoming dominant.

''The spread of Delta-variant infections in Asia is having a significant impact on mobility for the region, with congestion data for most cities tracked in the region showing a substantial decline in mobility,'' analysts at TD Securities explained.

''However, the risk to energy demand is mitigated as pent-up demand for travel surges outside of APAC, with air travel contributing to gains, which should still lead to epic demand growth in August. This increasingly points to a less cohesive world for energy demand, highlighted by widening Brent-Dubai spreads.''

Meanwhile, the prospects of an OPEC+ policy meeting remains elusive and a meeting this week is less likely, OPEC+ sources said.

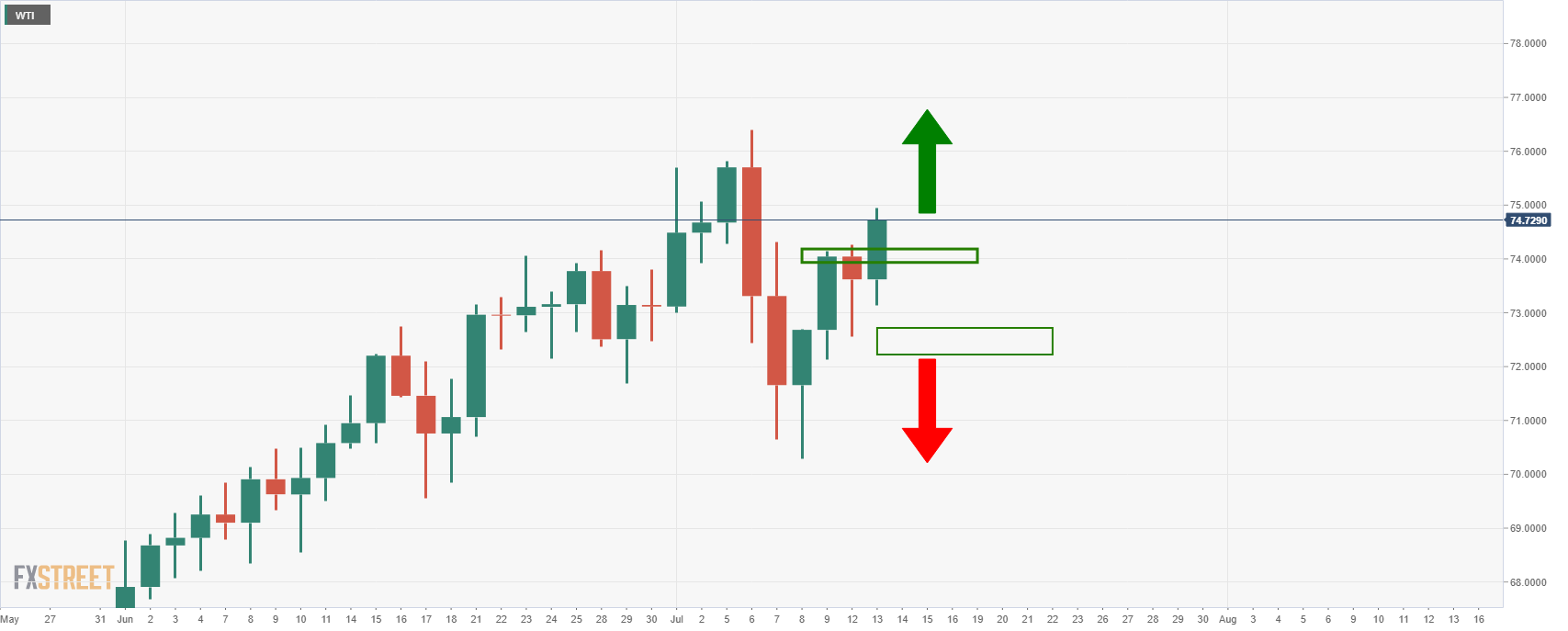

WTI technical analysis

The price is in the process of forming a W-formation which would be meanwhile bullish ad would be expected to surpass the prior highs.

That being said, a break of the recent lows will be significantly bearish for the medium term.