US Dollar Index hovers around the 93.60 zone

- DXY moves within the daily range near 93.60 on Thursday.

- President Trump ruled out participating in a virtual debate.

- US Initial Claims missed expectations at 840K last week.

The greenback, when gauged by the US Dollar Index (DXY), alternates gains with losses around the 93.60/70 band in the second half of the week.

US Dollar Index focused on politics

The index trades well within the multi-session consolidative range so far underpinned by the 55-day SMA (93.31) and capped on the upside by the 94.00 neighbourhood for the time being.

In the meantime, US politics takes centre stage once again after President Trump declined to participate in a virtual debate. It is worth recalling that the second debate was originally scheduled for October 15 in Miami.

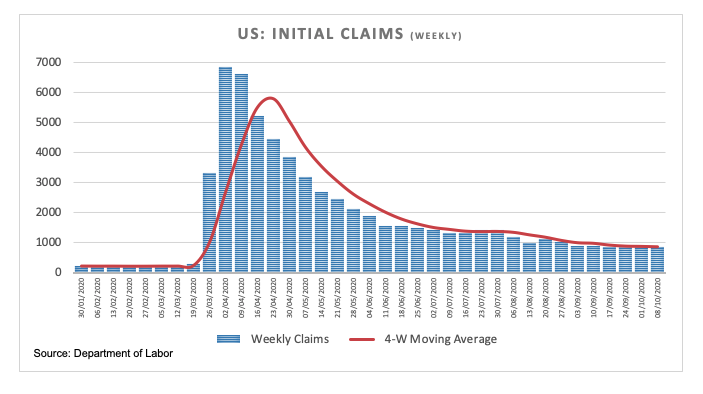

The dollar stayed apathetic on the back of another disappointing release of the weekly Claims, this time showing that 840K Americans filed for unemployment benefits insurance. The data still show a stagnant labour market despite latest Payrolls figures noted the jobless rate decreased to 7.9% in September.

Later in the session and closing the daily calendar, Richmond Fed Thomas Barkin (2021 voter, centrist) is due to speak.

What to look for around USD

The index appears to be moving into a consolidative phase, always below the key 94.00 barrier. Occasional bullish attempts in DXY, however, are (still) seen as temporary, as the underlying sentiment towards the greenback remains cautious-to-bearish. This view is reinforced by the “lower for longer” stance from the Federal Reserve, hopes of a strong recovery in the global economy, the negative position in the speculative community and political uncertainty ahead of the November elections.

US Dollar Index relevant levels

At the moment, the index is gaining 0.04% at 93.65 and a break above 94.20 (38.2% Fibo retracement of the 2017-2018 drop) would aim for 94.74 (monthly high Sep.25) and finally 94.99 (100-day SMA). On the other hand, initial support emerges at 93.34 (monthly low Oct.6) followed by 92.70 (weekly low Sep.10) and then 91.92 (23.6% Fibo of the 2017-2018 drop).