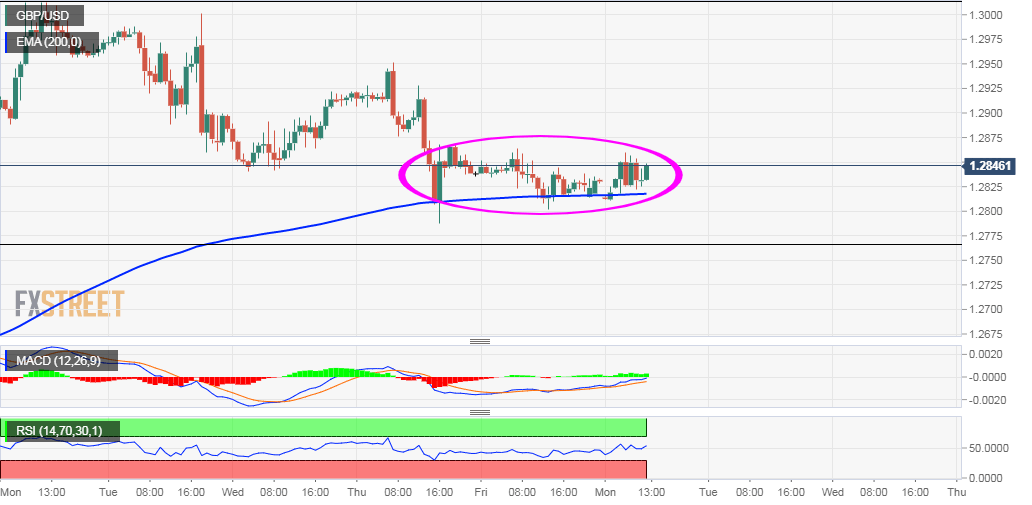

GBP/USD technical analysis: Trying to form a strong base near 200-hour EMA

- Intraday dips continue to find some buying near 200-hour EMA.

- Attempted move up might confront resistance near 1.2900 mark.

The GBP/USD pair lacked any firm directional bias and seesawed between tepid gains/minor losses, around the 1.2815-20 area through the mid-European session on Monday.

The intraday consolidation now seems to have formed a base near 200-hour EMA, which should now act as a key pivotal point and help determine the pair's near-term trajectory.

The mentioned region is closely followed by the 1.2800 handle and 23.6% Fibonacci level support of the 1.1959-1.3013 recent rally to multi-week tops – around the 1.2760 region.

Failure to defend the mentioned support levels might be seen as a trigger for bearish traders and prompt some aggressive selling, paving the way for a further near-term downfall.

The pair then could accelerate the slide further towards the 1.2700 round-figure mark before eventually falling to mid-1.2600s en-route the 1.2620-15 region (38.2% Fibo. level).

On the flip side, immediate resistance is pegged near the 1.2860-65 region, above which the pair is likely to reclaim the 1.2900 handle before darting towards the 1.2955-60 supply zone.

GBP/USD 1-hourly chart