Back

21 Aug 2019

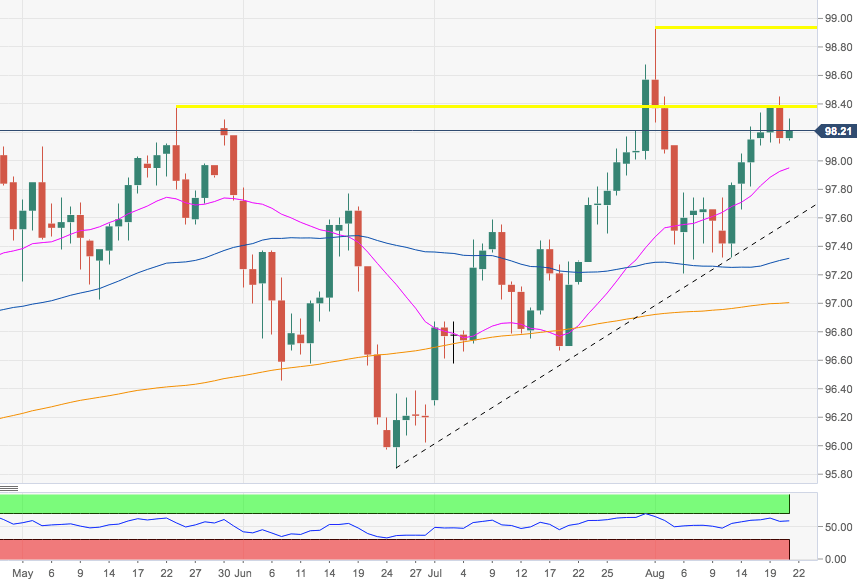

US Dollar Index Technical Analysis: Rally faltered near 98.50 ahead of key events

- DXY appears to have met a tough resistance in the 98.40/50 band, coincident with May peaks.

- Another visit to the 2019 highs just below the 99.00 barrier remains well on the cards as long as the short-term support line, today at 97.57, underpins.

- In the meantime, the index is looking to today’s FOMC minutes and Friday’s speech by Chief Powell for near term direction. The 21-day SMA at 97.90 should offer interim contention in case sellers rush to the markets, while the 2019 highs near the 99.00 mark should be the next target on a resumption of the up move.

DXY daily chart