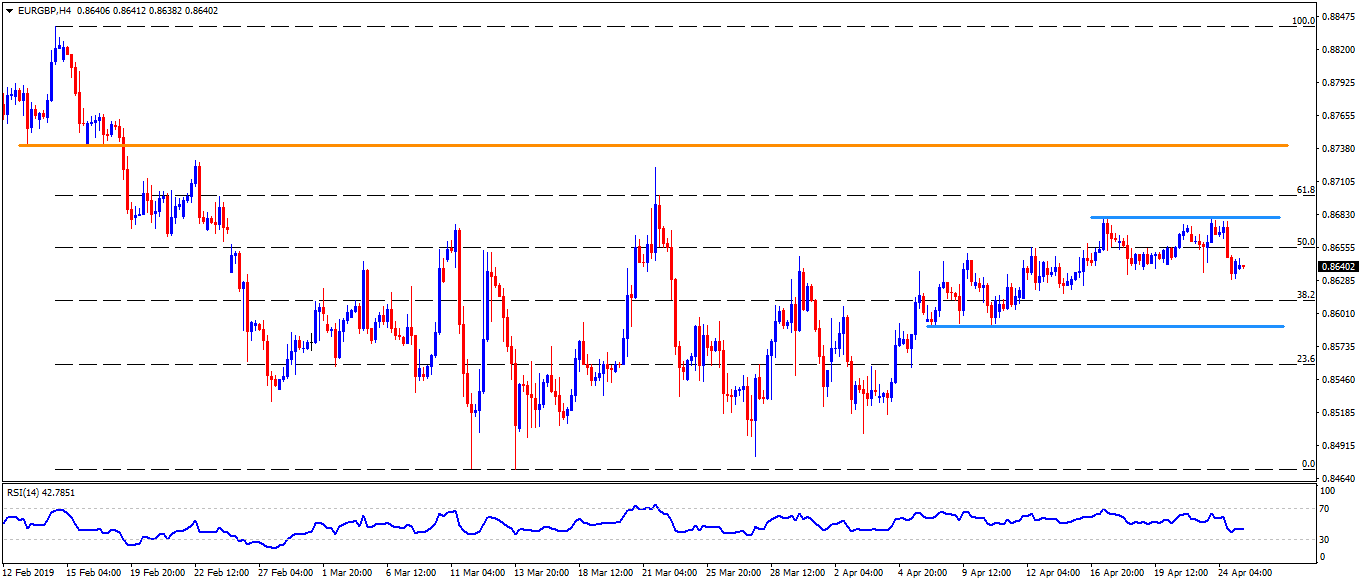

EUR/GBP Technical Analysis: Break of 0.8680/85 becomes necessary to avoid visiting 0.8590

EUR/GBP trades near 0.8640 during early Thursday. Despite repeated attempts, the pair couldn’t clear 0.8680/85 horizontal resistance comprising current month high.

As a result, chances of its pullback to 0.8590 support including lows marked on April 08 and 10 seem brighter. Though, 0.8620 may offer immediate halt during the downside.

Should there be increased southward pressure on prices under 0.8590, 0.8560, 0.8515 and 0.8470 are likely consecutive rest-points to appear on the chart.

Alternatively, 50% Fibonacci retracement of February to March decline near 0.8655 seem adjacent resistance ahead of 0.8680-85.

Given the pair’s successful rally beyond 0.8685, 61.8% Fibonacci retracement near 0.8700 and 0.8740/45 horizontal-region can gain Bulls’ attention.

EUR/GBP 4-Hour chart

Trend: Bearish