Back

19 Nov 2018

Gold Technical Analysis: Potential pullback to $1,217.70 a troy ounce

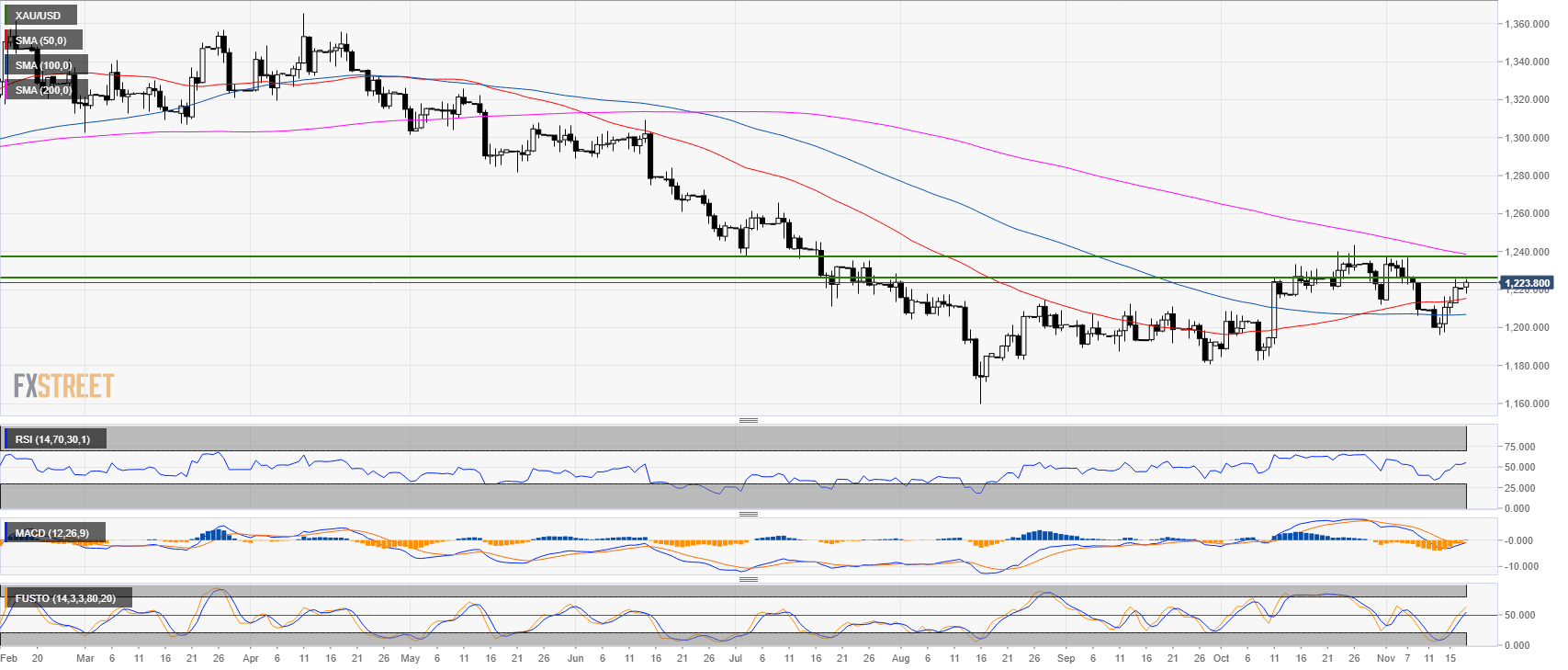

Daily chart

- Gold is trading in a bear trend below the 200-period simple moving average (SMA).

- However, bulls managed to claim the 50 and 100 SMA with the 50 SMA crossing above the 100 SMA.

- The RSI and Stochastic indicators are trading above the 50 line suggesting bullishness in the market. The MACD is also turning bullish.

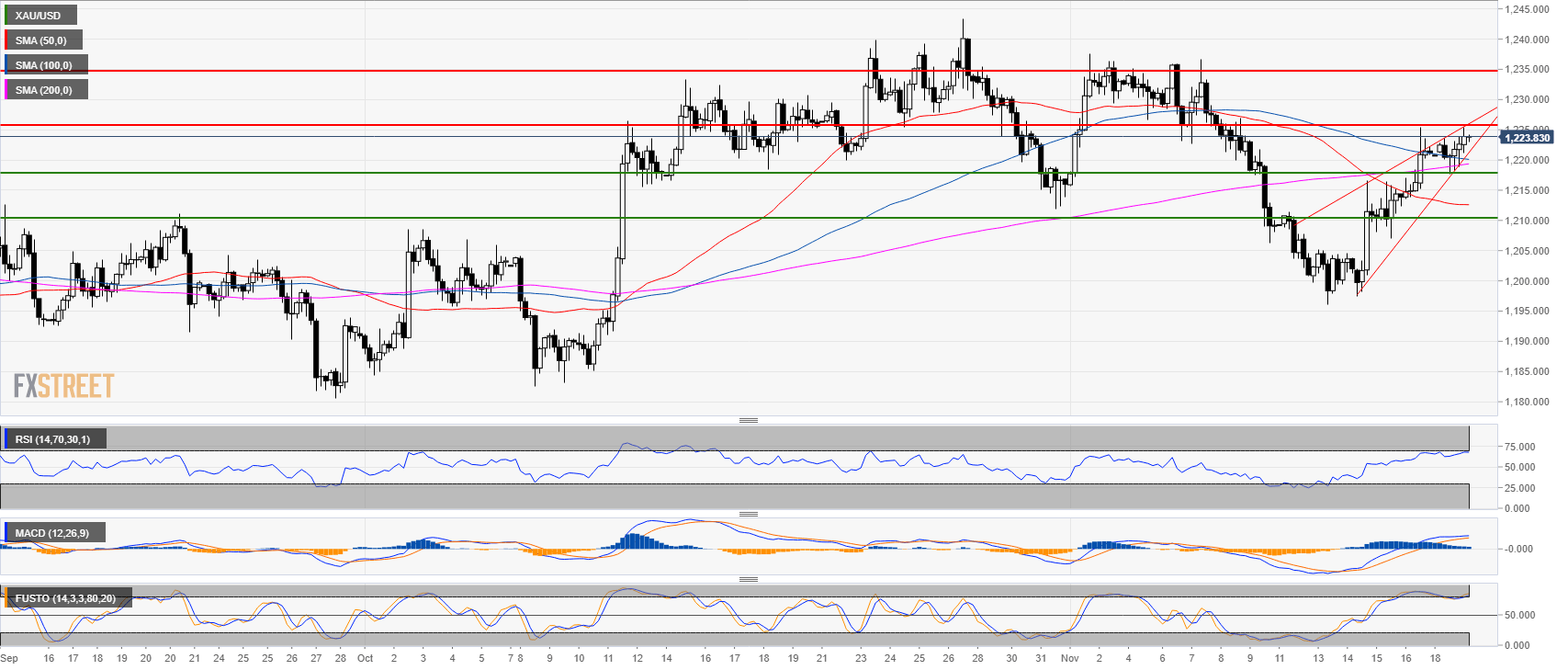

4-hour chart

- 1,225.40, the current high of the day seems to cap any further advances.

- Gold formed a wedge-shaped pattern with potential bearish implications.

- A pullback to 1,217.70 seems to be in the cards

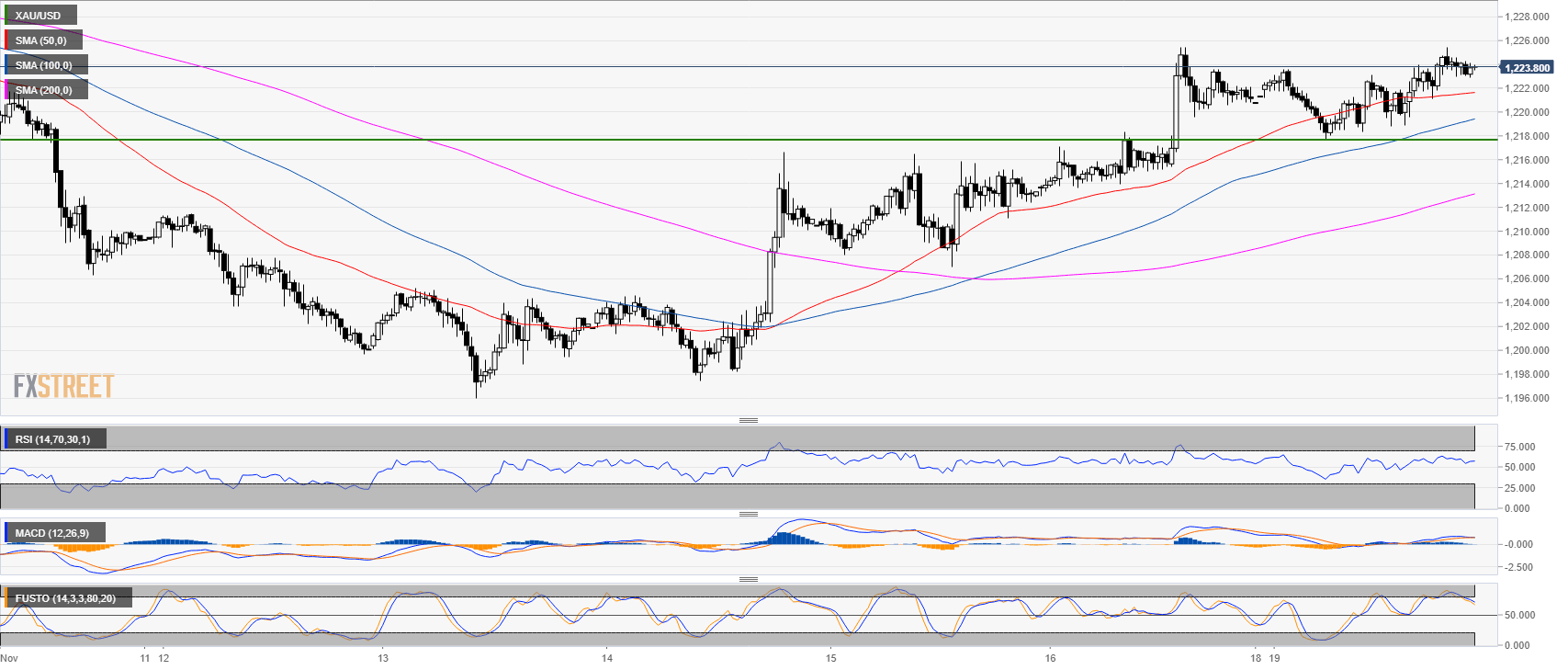

30-minute chart

- The RSI indicator is still above 50 while the Stochastic is leaving the overbought zone.

- The MACD is turning bearish. All suggesting that Gold might have a pullback to 1,217.70 soon.

Additional key levels at a glance:

XAU/USD

Overview:

Last Price: 1223.76

Daily change: 3.0e+2 pips

Daily change: 0.242%

Daily Open: 1220.8

Trends:

Daily SMA20: 1220.15

Daily SMA50: 1214.77

Daily SMA100: 1206.74

Daily SMA200: 1239.09

Levels:

Daily High: 1220.8

Daily Low: 1220.8

Weekly High: 1225.4

Weekly Low: 1196

Monthly High: 1243.43

Monthly Low: 1182.54

Daily Fibonacci 38.2%: 1220.8

Daily Fibonacci 61.8%: 1220.8

Daily Pivot Point S1: 1220.8

Daily Pivot Point S2: 1220.8

Daily Pivot Point S3: 1220.8

Daily Pivot Point R1: 1220.8

Daily Pivot Point R2: 1220.8

Daily Pivot Point R3: 1220.8