AUD/USD rejected near 0.7710; Aussie vulnerable against FOMC-US yields

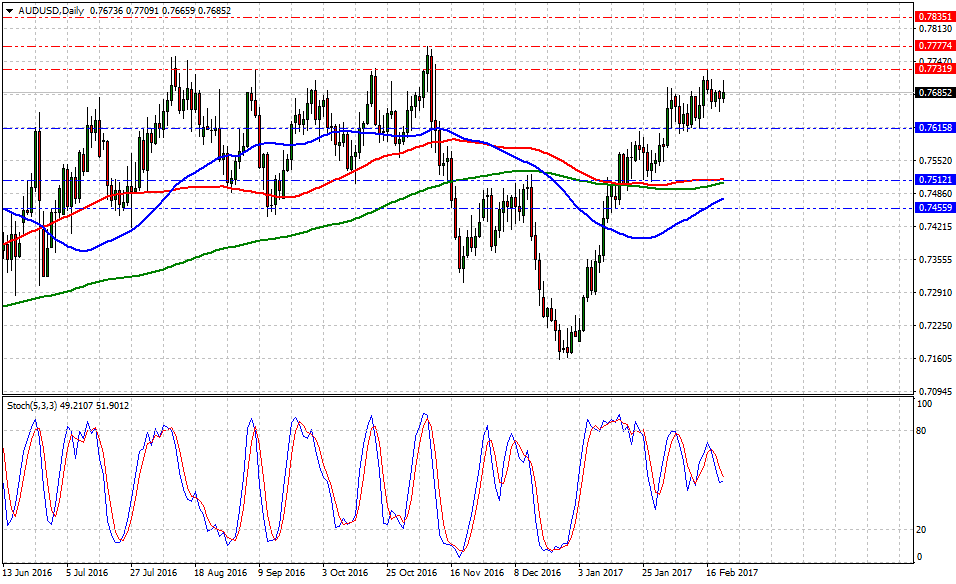

Currently, AUD/USD is trading at 0.7685, up +0.14% or 11-pips on the day, having posted a daily high at 0.7710 and low at 0.7666.

The Australian dollar vs. American dollar seems to navigate vulnerable to any positive dollar-long statement, news release or Trump's tweet as RBA's Lowe lowered the central bank's guard during yesterday's economic statement. Furthermore, the Aussie failed to gain traction above 0.7710 which indicates how commercials and institutional players see no value in exchanging above such significant level.

On the other hand, the US economic docket aligns two events: Existing Home Sales (MoM) and FOMC minutes including member Powell speech. These events may deliver the necessary value the US dollar is missing to move higher.

Historical data available for traders and investors indicates during the last 8-weeks that AUD/USD pair, a commodity-linked currency, had the best trading day at +1.18% (Jan.17) or 89-pips, and the worst at -0.81% (Jan.18) or (61)-pips. Furthermore, the US 10yr treasury yields have traded from 2.45% to 2.38%, down -1.18% on the day at 2.40% or -0.0286.

Technical levels to consider

In terms of technical levels, upside barriers are aligned at 0.7731 (high Feb.16), then at 0.7777 (high Nov.8) and above that at 0.7834 (high April.21). While supports are aligned at 0.7617 (low Feb.14), later at 0.7512 (100-DMA) and below that at 0.7459 (50-DMA). On the other hand, Stochastic Oscillator (5,3,3) seems to head south. Therefore, there is evidence to expect further Aussie losses in the near term.

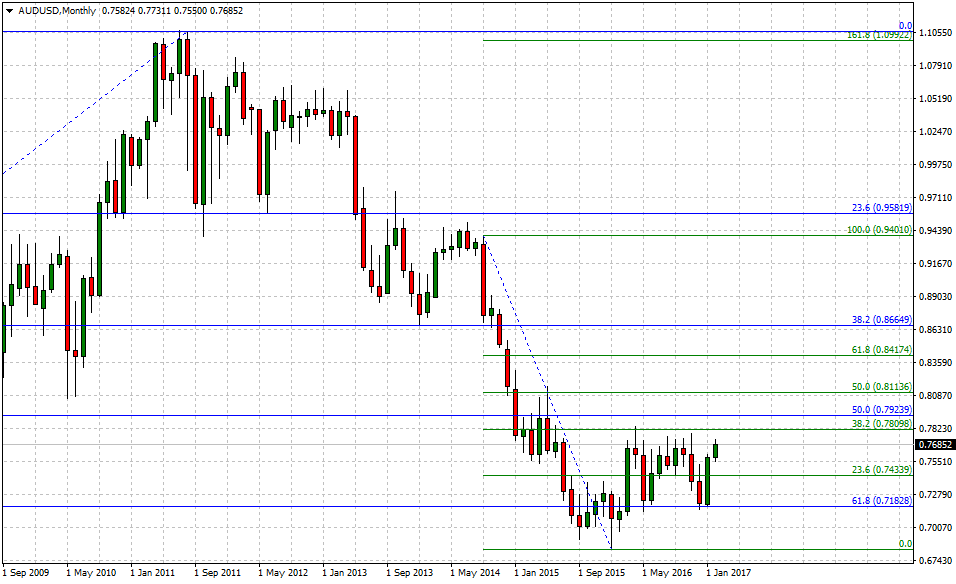

On the long term view, if 0.7834 (high April 2016) is in fact, a relevant top, then the upside is limited at 0.7809 (short-term 38.2% Fib). Furthermore, if the RBA has 'no ammo' nor solid reasons to increase rates in 2017, the interest rate advantage should decrease organically as the Federal Reserve continues increasing rates with 3-hikes in the next 16 months. To the downside, supports are aligned at 0.7433 (short-term 23.6% Fib), later at 0.7182 (reverse long-term 61.8% Fib) and below that back to 0.6826 (low Jan.2016).

AUD/USD analysis: no progress made, but downside still limited