Eurozone Inflation Preview: Headline measure to remain steady, core price pressures expected to cool down

- Eurostat is set to release key Europe inflation data on Wednesday.

- Headline annual inflation is seen holding steady at 2.6% in March.

- The European Central Bank (ECB) is expected to cut rates in June.

The Harmonized Index of Consumer Prices (HICP), a measure of inflation for the Eurozone, will be released on Wednesday, April 3. The inflation data from the old continent will be closely scrutinized by the European Central Bank (ECB) against rising speculation that the bank could start its easing cycle as soon as at its June event.

A glimpse at recent European data saw consumer prices in the euro bloc climb at an annualized 2.9% in the year to December 2023, just to recede in the subsequent two months to 2.8% and 2.6%, a move that mirrored other G10 nations.

In her last comments on March 20, ECB’s President Christine Lagarde expressed difficulty in determining whether the current price pressures stem merely from delays in adjusting wages and services prices, combined with the cyclical fluctuations in productivity, or if they indicate persistent inflationary trends.

Lagarde added that, unlike previous phases of their policy cycle, there are indications that the anticipated disinflationary trajectory will persist. Should the data unveil a significant correlation between the underlying inflation trend and the ECB projections, Lagarde thinks the bank can transition into the phase of scaling back its policy measures.

What to expect in the next European inflation report?

As a result, economists anticipate that Core HICP inflation will rise by 3.0% on a yearly basis in March (from 3.1%), while the headline gauge is seen rising by 2.6% from a year earlier, matching the gain observed in the previous month.

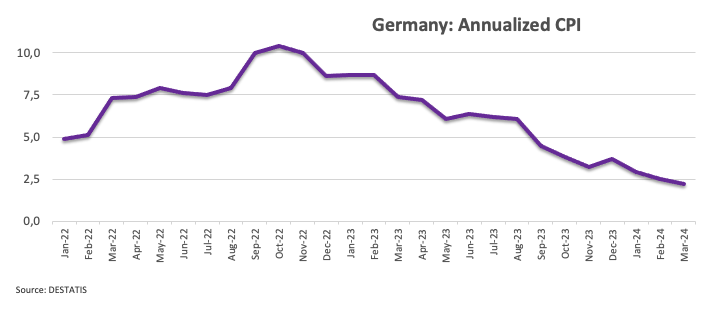

Reinforcing the idea of persistent disinflationary pressures, the advanced Consumer Price Index (CPI) in Germany rose by 2.2% on a yearly basis in March, down from February’s 2.5% gain.

According to the ECB Consumer Expectations Survey (CES), the median predictions for inflation in the next 12 months dropped from 3.3% to 3.1%. However, expectations for inflation three years ahead stayed steady at 2.5%.

When will the Harmonised Index of Consumer Prices report be released and how could it affect EUR/USD?

Eurozone preliminary HICP is due to be published at 09:00 GMT on Wednesday.

Heading into the highly-anticipated inflation release from Europe, the Euro (EUR) is struggling below the round milestone of 1.0800 against the US Dollar (USD), as investors continue to assess the likelihood of the start of the easing cycle by the Federal Reserve (Fed) in June.

According to Pablo Piovano, Senior Analyst at FXStreet, “Looking ahead, the EUR/USD is anticipated to encounter initial resistance at the key 200-day SMA at 1.0833. A move above this zone in a convincing fashion should restore the constructive bias and potentially allow for further gains in the short-term horizon.”

Pablo adds, “On the flip side, a reach of the so-far April low of 1.0724 (April 2) could trigger a deeper decline towards the 2024 low of 1.0694 (February 14).”

Economic Indicator

Eurozone Harmonized Index of Consumer Prices (YoY)

The Harmonized Index of Consumer Prices (HICP) measures changes in the prices of a representative basket of goods and services in the European Monetary Union. The HICP, released by Eurostat on a monthly basis, is harmonized because the same methodology is used across all member states and their contribution is weighted. The YoY reading compares prices in the reference month to a year earlier. Generally, a high reading is seen as bullish for the Euro (EUR), while a low reading is seen as bearish.

Read more.Euro price this week

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the weakest against the .

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.26% | 0.62% | 0.39% | 0.45% | 0.17% | 0.39% | 0.45% | |

| EUR | -0.26% | 0.36% | 0.15% | 0.19% | -0.09% | 0.13% | 0.20% | |

| GBP | -0.61% | -0.35% | -0.21% | -0.16% | -0.46% | -0.22% | -0.16% | |

| CAD | -0.40% | -0.14% | 0.21% | 0.05% | -0.24% | -0.02% | 0.05% | |

| AUD | -0.45% | -0.19% | 0.16% | -0.06% | -0.29% | -0.07% | -0.01% | |

| JPY | -0.18% | 0.11% | 0.46% | 0.25% | 0.32% | 0.23% | 0.27% | |

| NZD | -0.39% | -0.13% | 0.24% | 0.03% | 0.07% | -0.23% | 0.06% | |

| CHF | -0.46% | -0.19% | 0.18% | -0.05% | 0.00% | -0.29% | -0.06% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).