Back

28 Jun 2023

Gold Futures: Near-term rebound in store

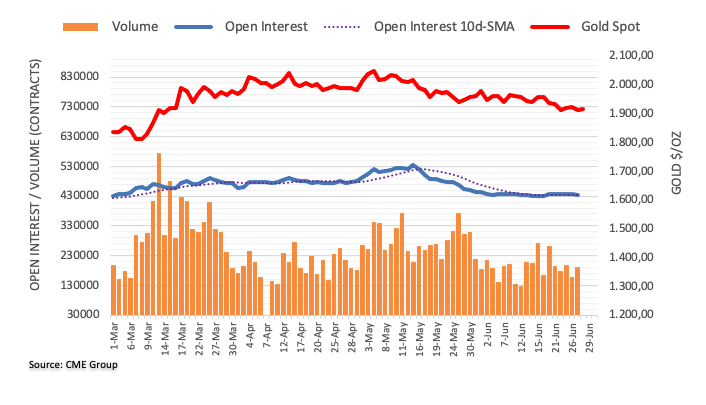

CME Group’s flash data for gold futures markets noted traders scaled back their open interest positions for the third session in a row on Tuesday, this time by around 2.3K contracts. Volume, instead, kept the choppy activity well in place and increased by around 33.5K contracts.

Gold appears capped around $1940

Tuesday’s pullback in gold prices was on the back of shrinking open interest, which hints at the idea that a potential rebound could be in the offing in the very near term. On this, occasional bullish attempts are expected to meet initial resistance around the $1940 region per troy ounce, an area coincident with the 100-day SMA.