AUD/NZD Price Analysis: Bulls test a key daily trendline resistance

- AUD/NZD bulls eye a break out of the bear cycle.

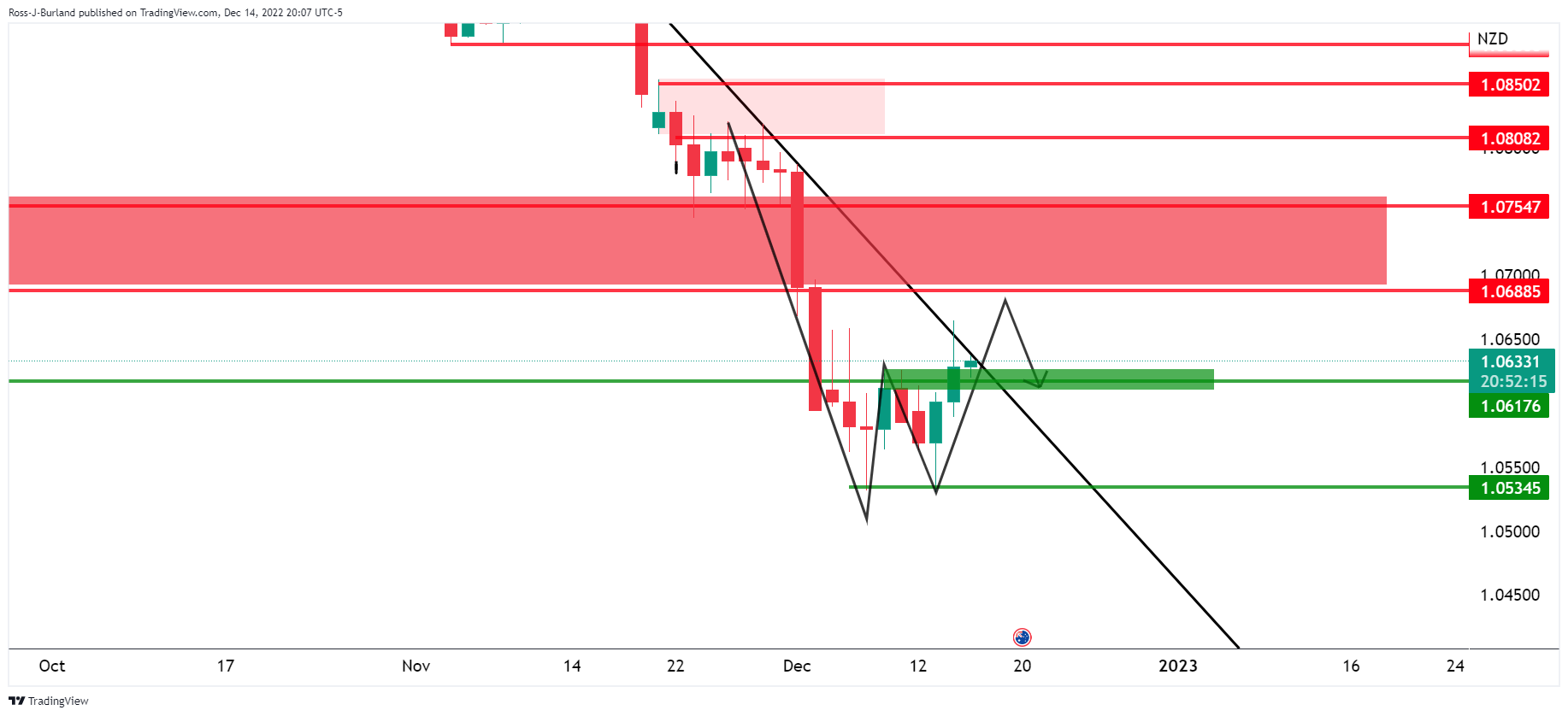

- A test of the bearish trendline could be on the cards for the days ahead.

AUD/NZD has rallied with AUD being a stronger performer of late. There have been two key releases for the pair with the New Zealand Gross Domestic Product and Aussie jobs data. However, the markets are digesting the Federal Reserve in the main and are consolidating recent moves. Nevertheless, the following technical analysis illustrates the potential for AUD/USD to break out of a key bearish cycle in the days and final weeks of the year:

AUD/NZD daily charts

As illustrated, the price is printing a W-formation while attempting to break the trendline resistance as it takes on the lower end of the 1.06s. The W-formation can be regarded as a double bottom and therefore a should the neckline hold on retests near 1.0620 on a closing basis,. then the upside is going to be looking favourable. A run to 1.0700 could be on the cards, a level that guards 1.0750 for the days/weeks ahead.